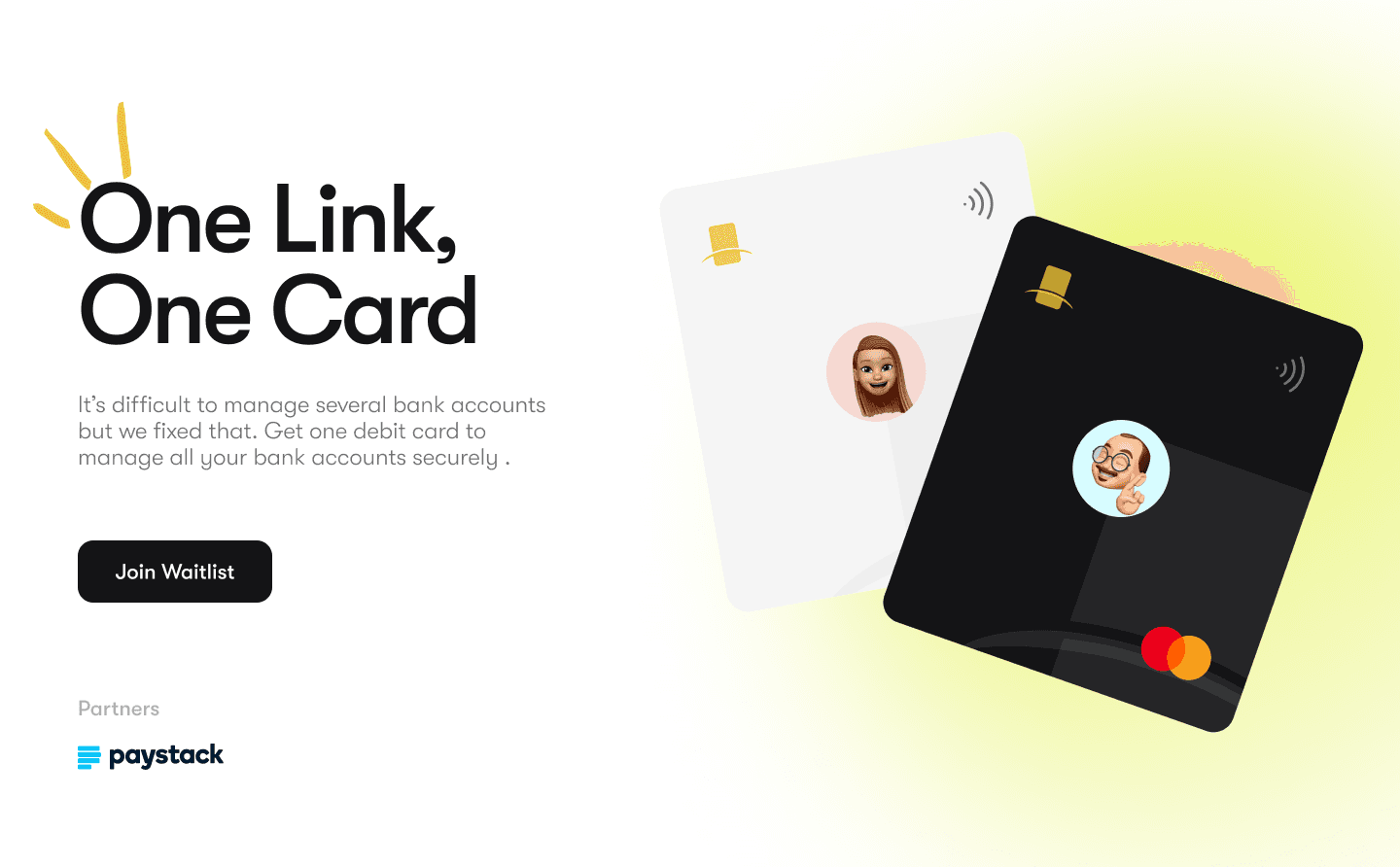

One Card for All Your Bank Accounts

In order to manage payments and withdraw money from any bank account, wherever in the globe, Bridgecard, a FinTech firm, provides you with a single debit card and a single mobile app. When our physical/virtual debit card and mobile solution were released, they generated $440,000 in pre-seed funding and saw an increase in usage two months later.

My Role & Responsibilities

I worked with a senior designer who led our team. We were both involved in every phase of designing the website, mobile app and the debit card. My specific responsibilities were:

Conducting user research and analysis

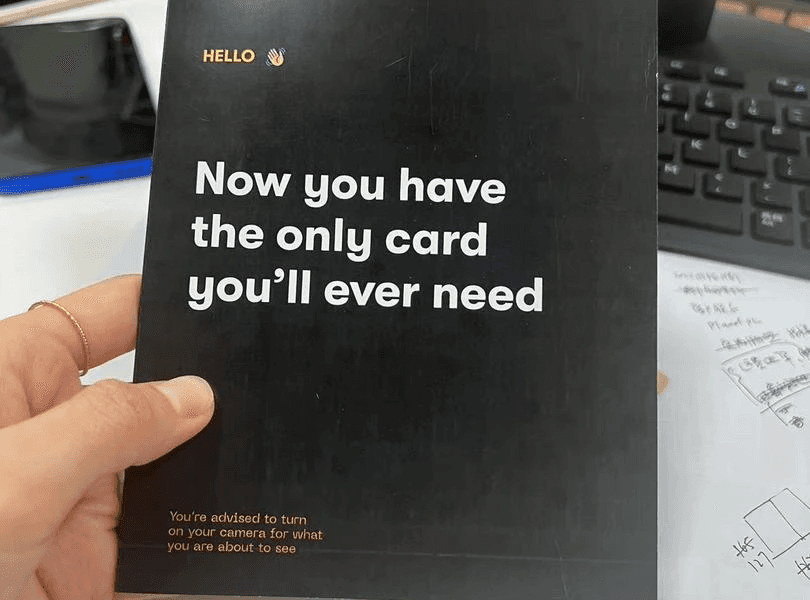

Designing the debit card and its packaging

Creating wireframes & prototypes as well as reiterations

Designing the marketing website and making it responsive

Copywriting for the product & marketing assets

Launching & marketing which took the product to active 1,000+ users

The Problem

A typical Nigerian has two to six bank accounts, each with a debit card. Despite 73.2% of Nigerians having active Nigerian bank accounts, managing multiple debit cards and its geographical and institutional constraints caused a drop in card payments. They present consumers with a number of difficulties, including:

High fees: Many traditional banks charge high fees for services like ATM usage, overdrafts, and monthly account maintenance.

Limited accessibility: Traditional banks may have limited physical locations, making it difficult for customers who don't live near a branch to access services.

Long wait times: Waiting in long lines at a bank branch can be frustrating, especially for customers who need to complete transactions quickly.

Limited banking hours: Traditional banks usually have limited hours of operation, which can be inconvenient for customers who work during those hours.

Lack of transparency: Traditional banks may not always provide clear and easy-to-understand information about their services, fees, and policies.

Limited account options: Traditional banks may only offer a limited range of account options, which may not meet the needs of all customers.

Security concerns: Customers may worry about the security of their funds and personal information when using traditional banks, especially if they have experienced fraud or identity theft in the past.

The Goal

With this secondary data and assumptions about the problem, we found that an opportunity was waiting to be explored and the goal was to design a simple, secure, and convenient way for users to manage payments and funds with one debit card.

User Research

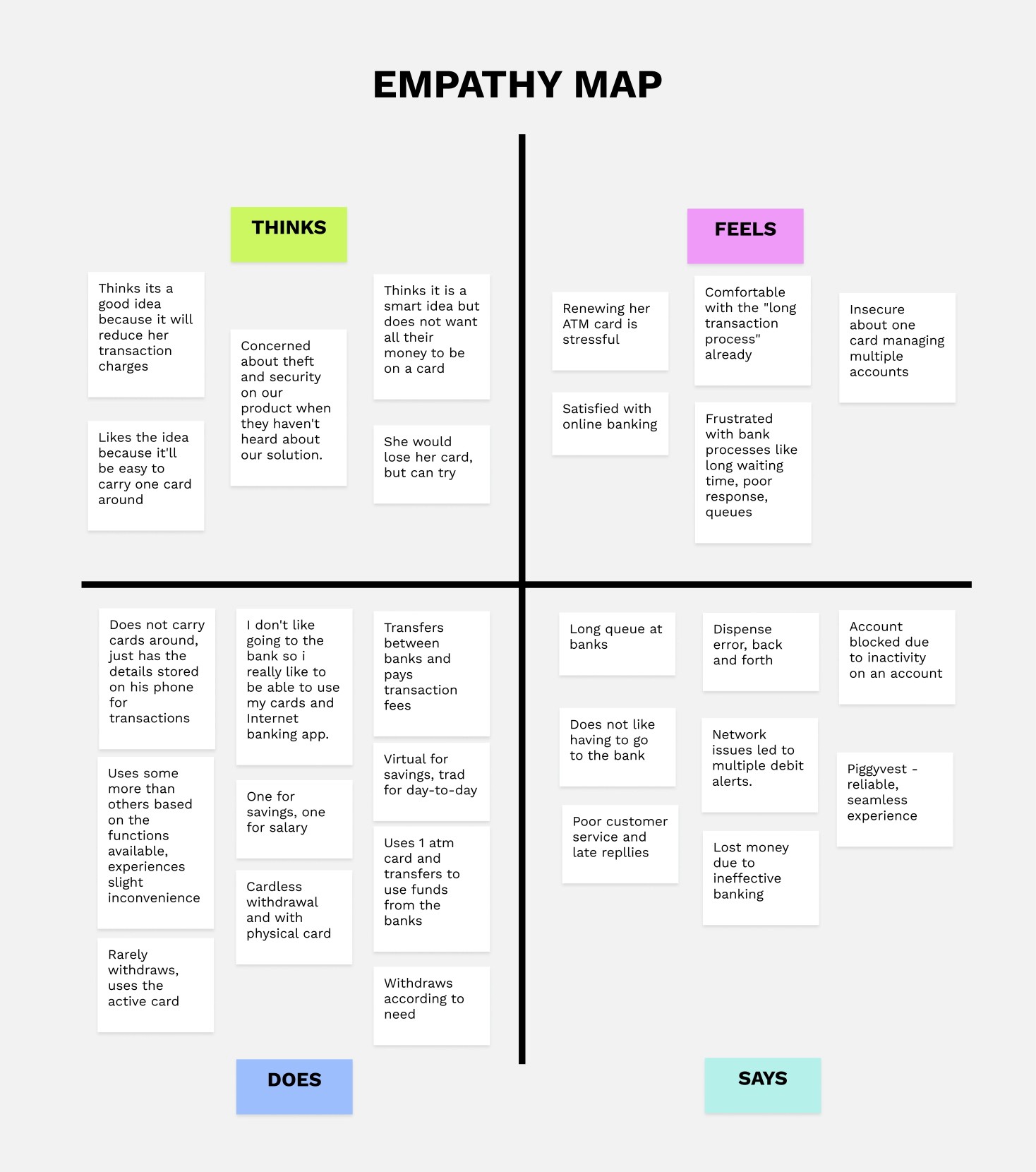

To ensure that we were addressing the correct issue and verifying our assumptions, we began by carrying out individual user interviews. This provided us with qualitative data on the problems and motivations in a contextual setting, helped us understand current behaviours, and confirmed our market suitability. We conducted interviews with 10 users who met the criteria of having at least two bank accounts, two debit cards, and using smartphones. We asked them questions on how many accounts/cards they owned, what their experience using and managing their accounts/cards were, how they managed withdrawals across multiple accounts and their experience with international payments.

According to the user research conducted, the major concerns raised by people who use multiple bank accounts include:

Having to queue at the bank to resolve issues

Incompetent traditional bank services such as poor customer service

Being unable to easily track payments and spending

Limited ability to perform international transactions

Security breach leading to loss of money or fraud

Designing the Solution

We began by exploring design concepts and potential solutions, taking into account the identified requirements necessary to address the issues at hand. We established an information architecture to help us translate these ideas into tangible products and tested multiple solutions against our primary goals, including assessing user satisfaction, determining whether the user experience is satisfactory, and measuring usability and identifying any concerns in the user flow.

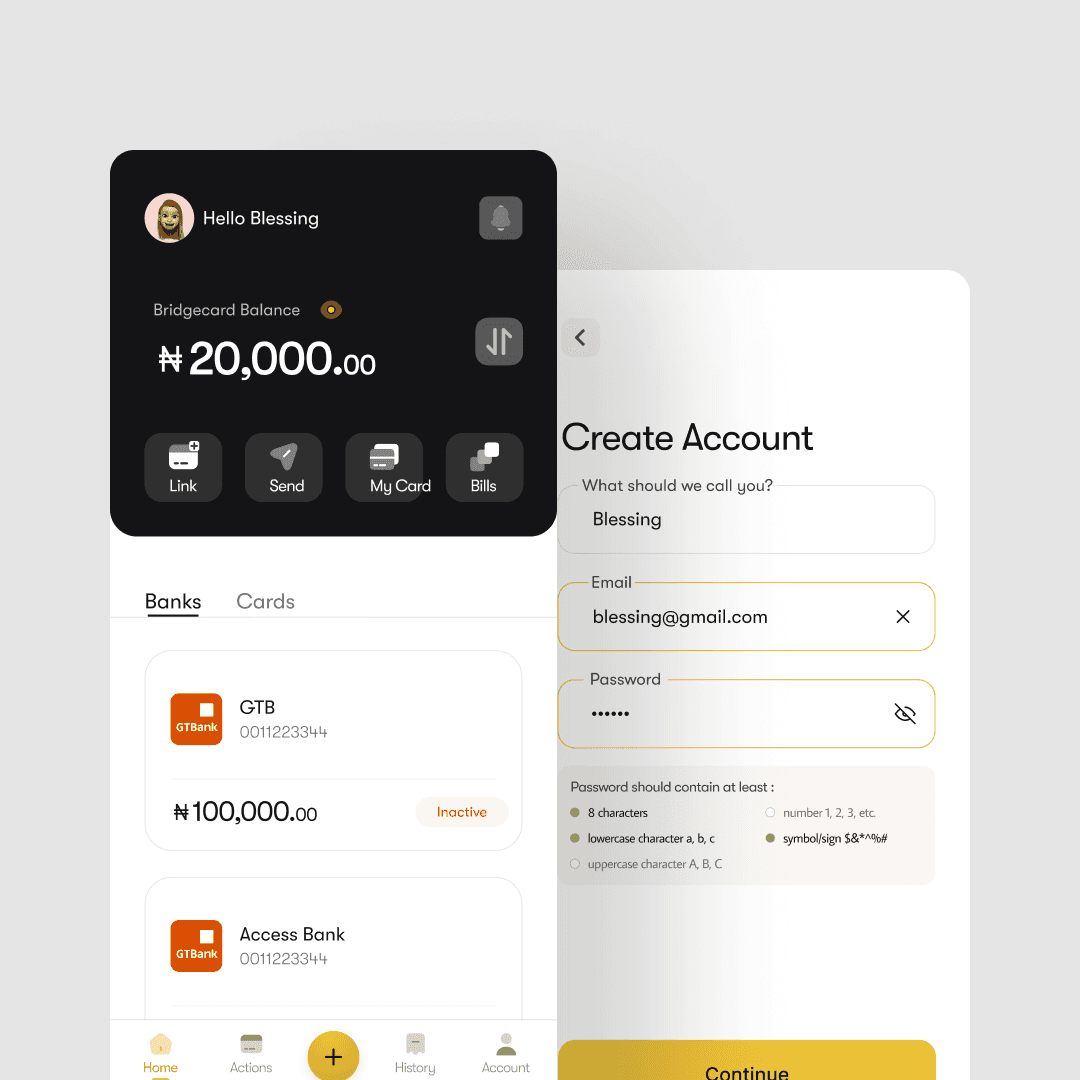

Lastly, we developed a mobile app that allows users to manage their finances and payments without having to switch banks or cards. The features included in the mobile app solved the identified issues stated earlier.

Our focus on security and KYC compliance allows users to set up their accounts quickly, with verification via BVN and PIN or biometrics for added protection against fraud.

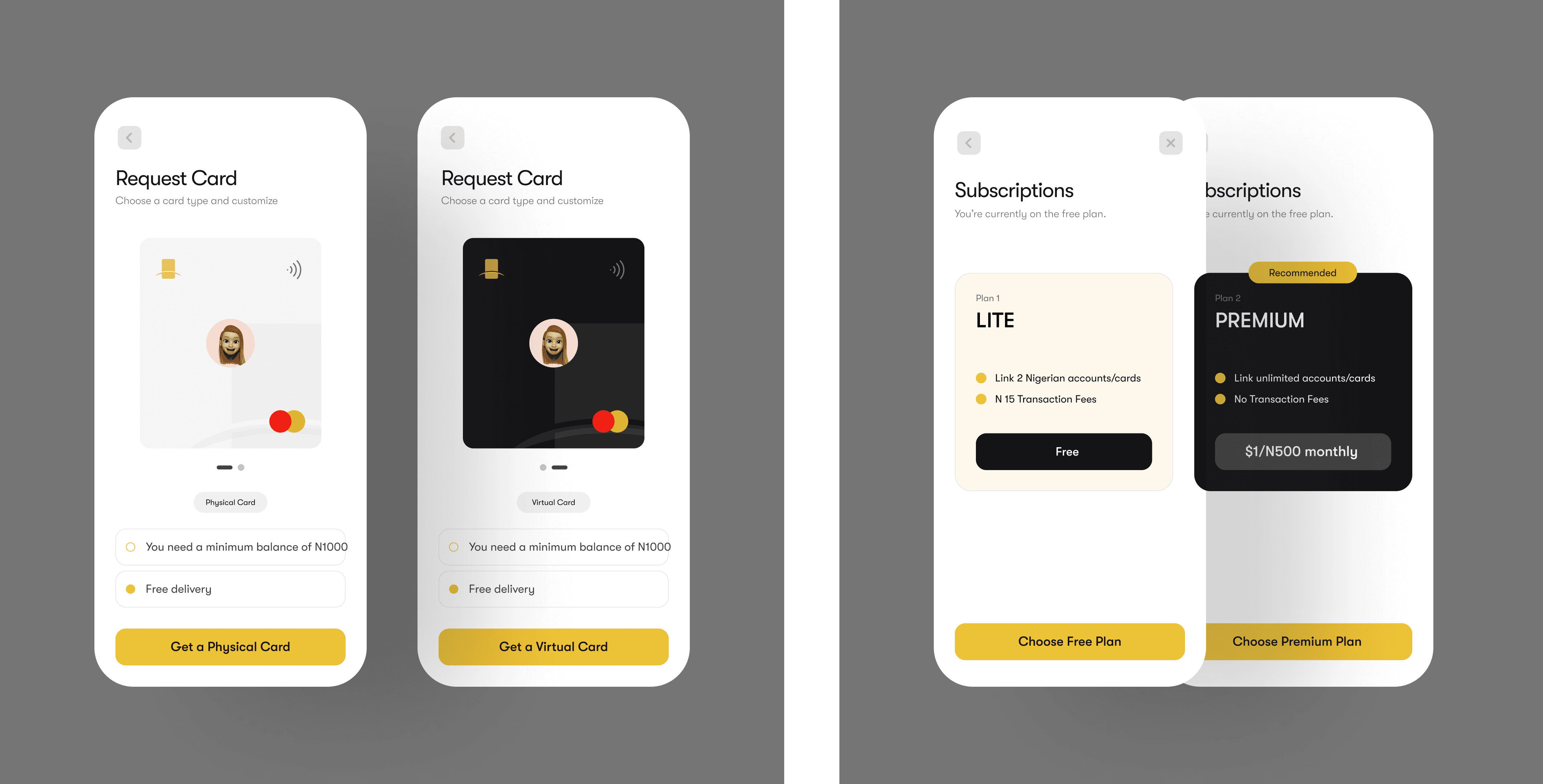

One common issue that we discovered during our research was the restrictions that come with using bank debit cards for international transactions, which affects 90% of users. But with Bridgecard, users can make global payments up to a monthly limit of $10k.

Linking an account is straightforward, with users easily inputting their card or internet banking details and verifying them with a one-time password sent to their registered bank email. Card request and activation are equally convenient, as users can request a card and activate it directly from the app without having to visit a physical bank branch or stand in long queues.

To help users monitor their expenses, we implemented an expense tracking feature, enabling them to track their spending and charges on any bridgecard, avoiding unnecessary alerts and helping them stick to their budgets.

User Testing

To evaluate the design and user experience, we conducted an analysis of the low-fidelity prototype with a small group of people and evaluated it based on the following criteria:

Navigation: We evaluated how easy it is for users to navigate the app, find information, and complete tasks.

User Interface (UI): We evaluated the app's design elements, such as colors, fonts, icons, and imagery, and how well they communicate the app's purpose.

User Experience (UX): We evaluated the overall user experience, including the ease of use, clarity of information, and efficiency of completing tasks.

Through user feedback, we refined our design over multiple iterations, resulting in a more positive response from users. We addressed issues such as improving the average duration of onboarding and linking an account/card, as well as resolving navigation problems before moving on to high-fidelity mockups for the minimum viable product (MVP).

Summary & Next Steps

The Bridgecard design project involved product design, UX strategy, and interactive prototyping. The aim was to design a simple, secure, and convenient way for users to manage payments and funds with one debit card, addressing challenges such as incompetent traditional bank services, inability to track payments and spending, and loss or fraud. The design team conducted user interviews, identified patterns and opportunities, explored design ideas, and developed key requirements to prioritise user needs. The resulting mobile app allows users to manage finances and payments without switching banks or cards, with features including security and KYC, linking of accounts/cards, card request and activation, international transactions and limits, and expense tracking. The project led to pre-seed funding of $440k and an increase in virtual card use 2 months post-launch.

Important Update: Kindly note that Bridgecard has pivoted from card payments to a card issuing company as at the last time this writeup was updated. The case study here describes the multiple bank accounts/card payments problem, and how it was solved.